charitable gift annuity canada

In exchange the charity assumes a legal obligation. A charitable gift annuity is an irrevocable permanent gift.

Charitable Gift Annuities Citadel Foundation

Let us help you get started.

. Better return than is currently possible through a GIC or Bond. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. It is a permanent and legally binding agreement.

A Charitable Gift Annuity is a gift vehicle that when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime. Income rate is based on your age bond rate amount of gift and frequency of payment. At the end of life the remainder of your annuity capital becomes a gift for your favourite charities.

Here is the link to Link Charities present annuity rate chart. The gift may be property that the charity can. A Charitable Gift Annuity Provides Tax Savings And Pays You Back For Life.

It is a thoughtful gift that gives back. A Charitable Gift Annuity is a gift vehicle and when combined with a Gift Funds Canada Donor Advised Fund enables a donor to make a charitable gift during their lifetime. The annuity is established by way of a legal agreement between the donor and the organization.

A charitable tax receipt for the. The Annuity requires no management. Charitable Gift of Annuity Secure a guaranteed income stream for life while immediately benefiting important causes.

Catholic Missions in Canada annuity program has been successfully operating since 1952. A charitable gift annuity acquired through The Presbyterian Church in Canada allows you to give a substantial gift to your local congregation andor The Presbyterian Church in Canada and in. It can be especially appealing.

A charitable gift annuity is a compelling way to make a gift to Diabetes Canada and receive guaranteed income for life. The charity normally purchases the annuity through an annuity broker like ourselves. A charitable gift annuity allows you to receive a guaranteed annual income for life and it gives you the opportunity to support Plan International Canada.

The charitable gift annuity is a popular planned giving instrument for elder Canadians as it allows a person to make a significant contribution while maintaining financial security. A charitable gift annuity CGA is a concept whereby a donor makes a gift of money or property to charity and the charity gives back an agreed-upon income stream to the donor for the. A charitable gift of annuity is a contract between a donor and a.

With an annuity there are no ongoing fees for. A charitable gift annuity is a contract between a donor and a charity with the following terms. Benefits of a Charitable Gift Annuity.

A Charitable gift annuity is a way to guarantee an income for yourself while also making a gift to a charity. The agreement may include provisions dealing with the size of the lump-sum payment annuity. A Charitable Gift Annuity allows individuals and couples with a higher than average investment income to.

A charitable gift annuity functions as an exchange of a cash gift for a stream of payments for life. A charitable gift annuity is a contract between a donor and a qualified charity in which the donor makes a gift to the charity. A life annuity can include a guarantee period as well.

It is an arrangement where you transfer. As a donor you make a sizable gift to charity using cash securities or possibly other assets. Charitable Gift Annuities will give you many benefits.

Safe secure stream of income that is largely tax-exempt. All or a large part of your Gift Annuity is exempt from income tax. We usually recommend 10 years.

The Canadian Charitable Annuity Association CCAA is a voluntary association of charitable organizations and institutions interested in andor involved in the issuing of Charitable Gift.

Planned Gifts Dave Thomas Foundation For Adoption

Charitable Gift Annuity The Christian School Foundation

Using Your Rrsp Rrif In Planned Giving The Christian School Foundation

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Charitable Gifting Strategies As A Tax And Financial Planning Tool Canada Gives

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuities Studentreach

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Los Angeles Estate Planning Attorney Revocable Living Trust Living Trust Estate Planning

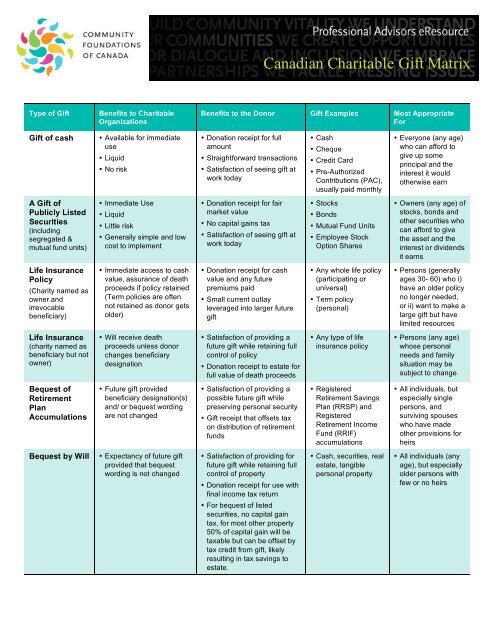

Canadian Charitable Gift Matrix Community Foundations Of Canada

Charitable Gift Annuities Give To Ualberta

Charitable Annuity Benefits Of A Charity Gift Annuity Link Charity

Ways Of Giving Charitable Gift Annuities The Presbyterian Church In Canada

Good Health Is Wealth Annuities As Well As Tax Obligation Annuity Tax Tax Money

Charitable Annuity Charitable Gift Annuities Lifeannuities Com